Benjamin Lucas, CEO of Amundi Technology, is the first British person on the fund manager’s exec committee.

In April last year Benjamin Lucas took on the role of chief executive of Amundi Technology, the European asset manager’s business dedicated to technology products and services for the savings and fund management industry.

Lucas told Markets Media: “I am the first British person on the executive committee, which is a really strong sign of the commitment to internationalising the business. This is important because technology is borderless and many clients look at technology as a way of accelerating cultural transformation.”

The majority of Amundi Technology’s most recent clients were from outside France, in continental Europe and across the wider world according to Lucas.

Previously Lucas was UK head of asset management, and the global head of asset management consulting at KPMG, and a common theme among clients was the critical importance of technology.

He felt that Amundi was attractive because the firm has a very bold view on having its own technologists leading the conversation on what the future looks like, and technology’s role in savings and investment. In addition, he described Amundi as the only European asset manager in the global top 10, which opens the doors to have conversations with clients across many touch points, and technology can be a big part of that conversation. Amundi had full-year 2023 net inflows of €26bn which took assets to €2,037bn as at 31 December, an increase of 7% over the previous year, according to the group’s results statement.

Amundi announced the creation of its new technology business line in 2021 to offer cloud-based software via Alto Investment, a platform covering the front-to-back needs of the asset management industry. The asset manager said the business would benefit from its demonstrated ability to implement software and transform operational models, such as through its acquisition of Pioneer Investments, its integration of Sabadell AM in Spain and the creation of a joint venture in China.

It could be argued that there is a conflict of interest in an asset manager providing technology to other fund managers, but this model has proved to be successful for competitors such as BlackRock, which provides the Aladdin technology platform. Lucas said that a massive portion of the market is already using the user-provider model and there are also lots of important safeguards and Chinese walls in place.

”At Amundi we “eat our own cooking”, we use our own technology, to face into the same problems as many of our clients, so it is incredibly important that we get it right both for Amundi and for our wider client base,” he added.

There are numerous technology providers but Lucas said that a differentiator for Amundi Technology is having a very broad offering that enables firms to scale efficiently, as Amundi has shown that it can be done.

“Another differentiator is our approach to relationships as we partner for a long-term future,” he said. “We are willing to explore contract periods that are much longer than average.”

He continued that Amundi’s culture is to put people, not technology first. His view is that digital expectations are set by people’ day-to-day interaction with technology and apps that are easy to navigate, easy to use, easy to engage with and that enterprise technology experience should not be vastly different.

Lucas gave an example of Amundi helping clients use artificial intelligence. Clients can quickly benefit from AI by using the corporate tools that are readily available but they have clear limits, which is where Amundi Technology can come into its own.

“We have specialist data scientists dedicated to working in our Alto platform in a safe, secure environment with investment data focused on solving client problems,” he added.

Growth strategy

In 2022 Amundi announced its strategic ambitions for the next three years, which included becoming a first-class provider of technology and services across the entire savings value chain.

Lucas said: ”There is a huge opportunity in Amundi’s technology capabilities that enables it to manage trillions of euros at an incredible cost to income ratio of 54%, which is very different to the majority of the market.”

He described the growth strategy as addressing the needs of clients who are trying to scale, and expanding in geographies where Amundi Technology sees significant potential. The wider asset management space is a growth area but he said Amundi Technology is also doing some really interesting things with asset owner clients and has had success in wealth management and private banking.

“A lot of our development teams have had success in the wider Credit Agricole hackathon and we are regularly tested on our capabilities,” he added, “However, we are also very open to programs such as IA Engine which does really great work.

Amundi is a subsidiary of French bank Credit Agricole and IA Engine is the Investment Association’s fintech hub which helps fuel the development of technology in investment management.

Amundi Technology has a host of products coming online in wealth distribution, asset servicing, and sustainability and climate platforms, which have had a very positive client reception according to Lucas.

Valérie Baudson, chief executive of Amundi, said on the full-year 2023 results call that technology and services is an important growth driver for the group.

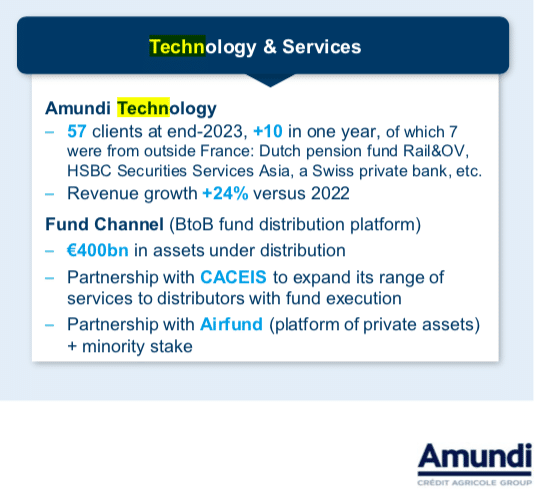

Amundi Technology gained 10 new clients in 2023 and revenues increased by 24% year-on-year to €60m.

“What is really important is that we have a very diversified client base in terms of types of clients, with asset managers, banks, insurers, pension funds, and also a very diversified client base geographically,” she added. “As in all businesses, it is really important to be able to show a track record, which is now the case.”

The 2025 strategic plan set a target of growing Amundi Technology revenues to €150m by 2025.

On the results call an analyst said it was encouraging to see growth increase in the technology business, but also highlighted that, at the current rate, the business would fall short of the €150m target by between €40m to €50m.

Baudson answered that it is very difficult to extrapolate revenues for the technology business as they are different for each client and the firm could suddenly win very big clients or several smaller ones.

“The only thing I can tell you is that we are convincing more clients every day and gathering more track records in various countries and geographies,” she said. “I am seeing that growth is there, that we can convince our clients, and we are very happy to go on investing in this area.”