Cboe Europe Derivatives (CEDX), the US group’s pan-European equity derivatives exchange, is planning to add single stock options as its pipeline of clients is increasing.

Iouri Saroukhanov, head of European Derivatives at Cboe Europe, told Markets Media that the launch of single stock options is a hugely important initiative and CEDX is also actively concentrating on pushing the liquidity on existing contracts.

“The first step was to launch index options and futures, and the second step is single stock options, putting us on the path to a holistic equity derivatives offering,” Saroukhanov added.

He joined Cboe in November last year after working in European listed derivatives markets for more than 17 years. Before Cboe Saroukhanov held senior trading roles at Liquid Capital Markets, running major derivatives risk books and managing trading teams.

When CEDX launched in September 2021 it offered trading in futures and options based on key Cboe Europe single country and pan-European indices. In February this year CEDX said it plans to offer single stock options on companies from 10 European countries from November 2023, subject to regulatory approvals. Options on stocks from additional European countries are expected to be introduced from February 2024.

Saroukhanov continued that over the last decade equity derivatives volumes have grown in Asia and the US but not in Europe, so there is a fundamental structural problem to be addressed. The problem is that the European derivatives market is made up of regional exchanges, so investors outside the region need to connect to multiple exchanges to get pan-European coverage. CEDX aimed to bring an on-screen market structure, similar to that used in the US, to Europe in order to help grow the region’s derivatives markets overall. For example, the pan-European equity and index options market is approximately one eighth the size of the US market.

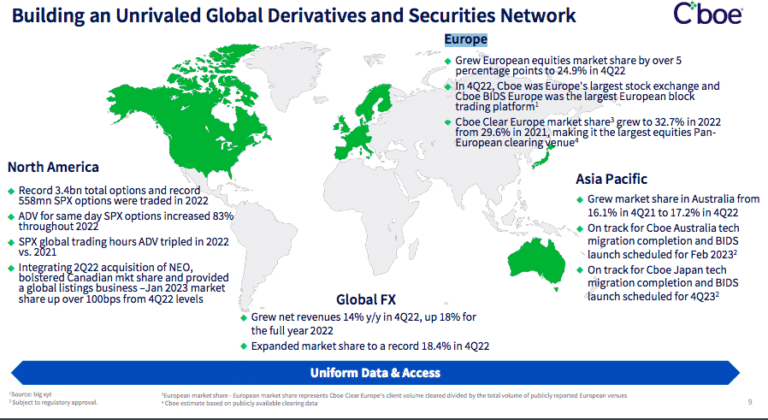

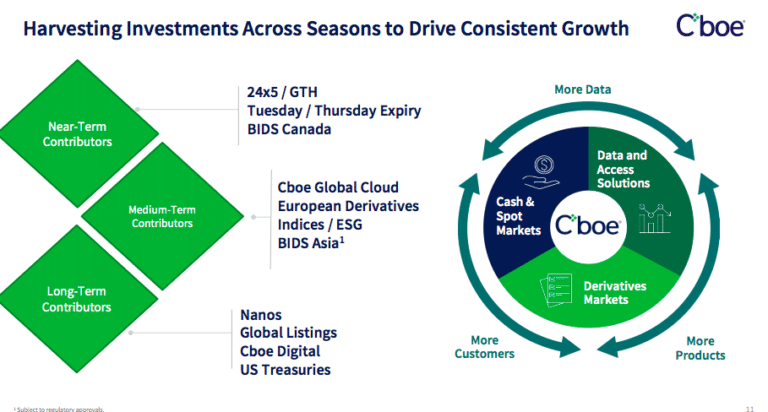

Cboe Global Market’s overall value proposition is providing uniformity of access to securities and derivatives markets across the globe according to Saroukhanov. Therefore Cboe decided to step into this space through the launch of Cboe Europe Derivatives to provide a single marketplace with a pan-European approach to satisfy demand from existing European participants and those outside Europe looking for a more efficient entry point into the region.

CEDX contracts are based on indices calculated using market data from Cboe’s European cash equities market, which the exchange said are transparently designed and managed under the same set of rules and perform closely in line with comparable benchmarks.

Saroukhanov said: “These indices are extremely competitive against the incumbent benchmarks because they offer a significant cost discount while being highly correlated.”

The exchange group also owns a European clearing house, Cboe Clear Europe, which clears cash equities from both Cboe Europe and other venues. Saroukhanov continued this gives Cboe Clear Europe an opportunity to be innovative in the way they model the risk offsets and there is potentially added value in efficient collateral management, with benefits being passed on to clients.

Volumes

Cboe Global Markets reported record fourth quarter and full-year results for 2022. Ed Tilly, chairman and chief executive of Cboe Global Markets, said on the results call that the derivatives business delivered strong results including increased demand from US retail investors.

“Retail volumes have the potential to grow in Europe and we would love to see that happen,” added Saroukhanov. “We would like to work with existing and new partners who are looking to develop that space.”

In the US there has also been an explosion of trading options with daily expiries, which Saroukhanov has not been purely driven by retail.

He said: “This is something we are willing to explore, and micro contracts are also on our radar, if there is demand and support from the trading community.”

In January this year CEDX traded 3,824 contracts, a record monthly figure which beat the previous high of 3,647 contracts in December 2022.

Saroukhanov said volatility has helped CEDX increase volumes but the business has added new participants over the last few months, which has been the main driver of growth.

In November last year CEDX said it welcomed three new trading participants – Barak Capital Israel, Barak Capital Market Making B.V. and TTG Capital Limited.

“Our pipeline of clients is rising and will increase as new products are introduced,” added Saroukhanov.