Market participants open and trade positions on the same day that options expire.

Edward Tilly, chairman and chief executive of Cboe Global Markets said there has been a fundamental evolution in options trading as many market participants now open and trade positions on the same day that options expire.

Tilly said on the first quarter results call on 5 May that Cboe continued to make progress delivering on its top strategic growth priorities – derivatives, data and access solutions, and Cboe Digital.

Takeaways from our Q1 earnings release and webcast:

-Index #options ADV up 49% YoY; multi-listed options ADV up 1% YoY

-Record #VIX and #SPX options volume during GTH

-Cboe Europe cash equities market share up 3% YoY

-Growth in #DataAndAccess Solutions powered by comprehensive… pic.twitter.com/d66yfECZD0— Cboe (@CBOE) May 5, 2023

Total net revenue for the derivatives business increased 29%, which Tilly said was driven by the strength of index options and volatility products, solid volumes in multi-list options trading. In particular, he highlighted that recent enhancements implemented to expand access to options including expanded trading hours and new expirations have created new opportunities for customers.

SPX (S&P 500) options average daily volume increased 59% to a record 2.8 million contracts during the quarter, including a single-day record of 4.2 million contracts traded on 10 March. Mini-SPX options contract volumes increased 195% year-over-year and average daily volume for VIX Options increased 18% year-over-year in the first quarter.

“We continued to see many market participants opening and trading positions on the same day the options expire, as they engaged in tactical trading strategies around market events,” said Tilly. “We believe there has been a fundamental evolution in how customers are trading this product and we anticipate this volume will continue.”

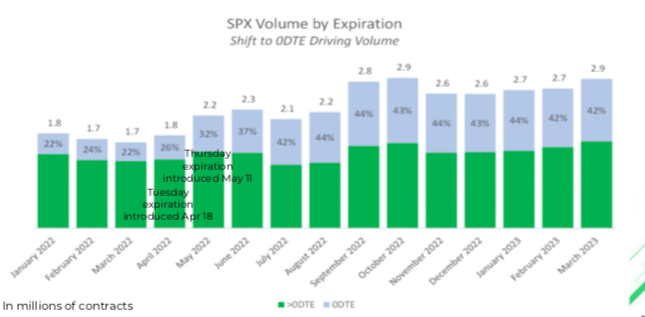

Average daily volume for SPX options opened on the same day of expiration comprised nearly 43% of overall SPX volumes in the first quarter and nearly 45% of SPX volume in April according to Tilly. As a result the exchange recently announced the launch of the Cboe 1-Day Volatility Index, which measures the expected volatility of the S&P 500 index over the current trading day.

Tilly continued that the explosive growth of same day options started about a year ago, primarily retail platforms, but there is now increasing institutional adoption,

“They really capture the news of the day,” added Tilly. “Investors can pinpoint the uncertainty in the daily news cycle and trade around that without buying weeks or months of premium.”

He gave the example of traders wanting to trade on the day the Federal Reserve announces interest rates and just want to isolate that day’s exposure.

“We are measuring the potential in the amount of inbounds that we have for data modelling short-term exposure,” he added. “We’re encouraged by the commentary and the feedback that we are getting from our user groups more broadly.”

Jeff O’Connor, Head of Market Structure, Americas at Liquidnet, agreed in an email that there has been a trend of traders hedging against or betting on turmoil in the form of zero-dated options, and they can account for as much as 40% of the S&P 500’s options volume.

“The VIX is calculated using derivatives that expire 23 to 37 days into the future, maybe contributing to the lack of near term sentiment reflection,” he added.

VIX, Cboe’s Volatility Index, is a real-time market index representing the market’s expectations for volatility over the coming 30 days.

“The volatility of the volatility measure is showing early growing pains with considerable fluctuations in price,” said O’Connor. “It’s certainly a cowboy market but maybe a measure worth keeping tabs on as the VIX is poorly reflecting actual risk sentiment for some time now.”

Cboe Digital

Tilly said Cboe Digital continued to onboard new participants during the first quarter as liquidity deepened and the exchange’s spreads compressed to competitive levels compared to other U.S.-based platforms.

“February represented our best month to-date with average daily volume of more than $100 m and we had a record first quarter with $7.4bn traded,” he added.

In May 2022 Cboe Global Markets completed its purchase of Eris Digital Holdings (ErisX), an operator of a US-based digital asset spot market, a regulated futures exchange and a regulated clearinghouse, which is the cornerstone of the Cboe Digital business.

David Howson, Cboe Global Markets

David Howson, Cboe Global Markets

The Commodity Futures Trading Commission is reviewing Cboe’s application for margin futures according to David Howson, president of Cboe Digital Markets.

“We have a number of FCMs (futures commission merchants) lined up and ready to begin to onboard once we receive that authorisation, from there things will move pretty quickly,” he added.

Howson continued that while many activities in the spot crypto trading are hampered by the US Regulatory environment, listed derivatives products have full regulatory clarity, which is an enabler. Once CFTC approval has been received, clients will be able to trade spot crypto alongside margin derivatives, which provides a big efficiency in terms of capital requirements and not having to connect to multiple platforms.

International volumes

There was increased demand from non-U.S. customers and liquidity providers for the ability to trade SPX and VIX products across all time zones, day and night.

“As a result, we have seen a sizable increase in volume during our Global Trading Hours session with average daily volume for SPX and VIX options increasing 121% and 118%, respectively, year-over-year,” said Tilly.

During the first quarter the exchange announced plans to expand Cboe Europe Derivatives’ product suite to include single stock options on European companies. They are expected to be available for trading in November this year and cleared by Cboe Clear Europe, subject to regulatory approvals

Cboe Europe Equities increased first quarter market share 3% year-over-year to 24.9% and Cboe Clear Europe market share grew to 34.1% from 32.2% in the same period, which the firm said makes it the largest pan-European clearing venue. Cboe BIDS Europe had 36.3% market share in the quarter, extending its run as the largest European block trading venue to 12 consecutive months according to Tilly.

In March Cboe completed the technology migration of Cboe Australia and launched Cboe BIDS Australia.

“We also welcomed Emma Quinn as the new President of Cboe Australia and we could not be more excited to have her leading our efforts in this key region,” added Tilly.

In Japan, equities market share rose to 4.8% during the first quarter from 3.8% a year ago.

“We also remain on track for the Cboe Japan technology migration and expected launch of Cboe BIDS Japan in the fourth quarter of this year, subject to regulatory approval, further extending our reach of the BIDS network into another key global equity market,” said Tilly.

Financials

During the first quarter Cboe’s net revenue 13% year-over-year to a record $471m.

Brian Schell, Cboe Global Markets

Brian Schell, Cboe Global Markets

Brian Schell, chief financial officer and treasurer, said on the results call that record revenue performance was driven by the continued organic growth of the derivatives franchise, as well as a steady contribution from the data and access solutions business. Options delivered the highest growth of any segment for the quarter, with net revenue increasing 28% year-on-year.

“The first quarter was not only a period of robust financial performance, but it also marked a period of meaningful advancement for many of our strategic initiatives,” added Schell.

He continued that with recent launch of Cboe One Options, the group expects an uptake for all the Cboe One data feeds in the second half of this year, adding incremental revenue for the data and access solutions business.

Schell said: “Following the migration in Australia, we would expect to see increased demand for Cboe data, consistent with what we have seen following past technology migrations around the globe.”