CME Group sees growth potential in futurization, or providing an alternative to over-the-counter markets, as capital efficiency has become more important with regulatory tailwinds, such as the uncleared margin rules.

Regulators have phased in uncleared margin rules since 2008 to reform the over-the-counter derivatives market and encourage a shift of more products into central clearing following the global financial crisis. The new rules require counterparties to OTC derivatives to post margin on a segregated basis.

Paul Woolman, global head of equity index products at CME Group, told Markets Media that growth has accelerated in OTC alternatives for the last few years, and in 2022 volumes increased by as much as 45%.

“They are reaching critical mass in terms of open interest and we expect that trend to continue,” he added.

Woolman took on his current role, overseeing CME’s equity index product portfolio, in October last year. He joined CME Group in 2016 as senior director, head of EMEA equity products and alternative investments. Prior to CME Group, Woolman served as a delta one equity derivatives trading director at Bank of America Merrill Lynch for 11 years, where he managed exposure across futures, exchange-traded funds, swaps, and structured products, as well as cash equities and foreign exchange.

Woolman said: “In the last six months we have had an increasing number of inquiries around capital efficiency, so these products are becoming more and more relevant.”

For example, CME’s Adjusted Interest Rate (AIR) Total Return futures on US indices have been growing very strongly for the last couple of years according to Woolman, and he expects that will continue in 2023.

In addition, Woolman added that CME’s Equity Index Dividend futures have grown significantly on the S&P 500 Index. Last year CME also introduced dividend futures on the Russell 2000 and Nasdaq-100 indices and he said they have started to trade more actively this year.

Another product for capital efficiency is equity index sector futures.

“Sectors often trade via swaps or fully funded ETFs and we think some of that will port over to the listed derivative space,” added Woolman. “All these OTC products had record average daily volumes last year, and we are thinking about how we can extend the suite and fulfil demand.”

A second theme for potential growth is in options trading, especially in the E-mini suite, which are much smaller in size than standard contracts.

Woolman said: “There was fantastic growth last year of over 60% on the E-mini S&P 500 and Nasdaq-100 options.”

CME has been listing more daily expiries to cater for the trend of short-term trading. By the end of February, CME will have daily expiries on all main equity index options, on both the E-mini and Micro E-mini versions.

The third area for growth potential is retail trading, where Woolman said Micro E-mini futures have been a huge success and adoption grew very quickly.

CME has four micro E-mini futures in equities which Woolman described as launching very successfully and trading about 3.1 million contracts in aggregate last year. CME can apply micros to other index properties and he said there will be more in that space down the line.

In addition, CME announced the upcoming launch of Micro E-mini S&P MidCap 400 and Micro E-mini S&P SmallCap 600 futures on March 20.

“With the addition of these two new contracts, we will now have Micro E-mini futures available to trade across the entire suite of S&P indices – large-, mid-, and small-cap – both extending the reach of these sectors to a broader array of market participants, as well as providing a more precise toolset for investors to scale index exposure,” added Woolman.

He continued that retail investors have been trading more options and as they are becoming more familiar with futures and options, this should continue to be a growth driver.

“Over the last few years we have had the pandemic, the recovery, inflation scenario and the energy crisis which show that index choice really matters,” he said. “Index properties on the main US benchmarks have performed very differently in the past, so investors need to consider other indices to manage risk and not just default to S&P 500.”

Environmental, social and governance strategies

Woolman admitted that ESG has been a focus for many clients over the last few years in terms of derivatives.

“We are developing themes for liquid ESG products which will be useful in portfolios,” he added.

CME consulted with the marketplace to launch the E-mini S&P 500 ESG index which Woolman said has become the most liquid equity ESG future globally in terms of notional trading per day, and average daily volume grew about 50% last year. CME have also launched the S&P Europe 350 ESG Index, which has the same methodology as the US version.

“ESG is a bespoke market and everyone’s interpretation and implementation is different which can make it challenging to develop standardised products,” said Woolman. “There is a great deal of interest in the space and we are thinking about what should come next, which could be contracts with a climate-related focus.”

Volumes

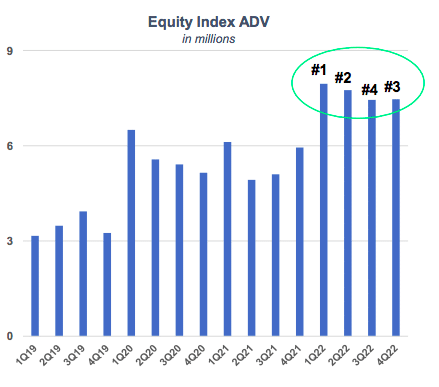

CME Group had its best ever fourth quarter in 2022, with record average daily volume of 21.8 million contracts resulting from double-digit growth in equity index and foreign exchange.

For 2022 CME Group reported a 19% increase in average daily volume to a record 23.3 million contracts, with new records in financial products, options on futures, and volume from outside the United States.

“Our contracts trade around the clock and around the globe,” Woolman said. “We have global participants trading in all regions and a lot of our liquidity is outside US hours which is important for local relevance.”

Woolman said: “We had a fantastic year in 2022 with volumes up almost 40% across our equity suite and it is important to continue that success.”

He admitted that the macro environment and volatility affects volumes.

“However, CME Group is trading substantially more volume across our equity suite than during comparable volatility environments in the past,” added Woolman.