There will be differences in settlement periods within global ETF baskets.

Participants are increasing automation for exchange-traded funds ahead of the settlement cycle in the US and Canada being reduced, which increases risk for ETFs which have global baskets containing differing settlement times.

The standard settlement cycle for most US broker-dealer transactions in securities will be reduced from two business days after a trade, T+2, to T+1 on 28 May 2024 in the US and on the previous day in Canada. The US Securities and Exchange Commission said the aim is to reduce latency, lower risk and promote efficiency and greater liquidity but it requires streamlined and efficient operational processes, presenting an opportunity to increase post-trade automation.

The challenges of the US and Canada moving to a shorter settlement cycle were discussed in a webinar hosted by financial services group Brown Brothers Harriman, Talking T+1: Navigating the global impacts on ETFs, on 9 February 2024.

John Hooson, ETF specialist at BBH said on the webinar that the firm has seen a lot of focus on US ETFs with global portfolios, where the US will be moving to a T+1 but the underlying securities will not.

Hooson said: “For global baskets, we are going to see some dislocation that needs to be managed as one party is going to be exposed to the other for an extra day.”

He expects a rise in collateral costs due to the increased risk of mismatches in settlement times, for example, when an authorized participant (AP) is delivering a basket to a fund such as a Euro Stoxx 50 ETF listed in the US. The European securities are generally going to settle on a T+2 basis, while the ETF will settle a day earlier.

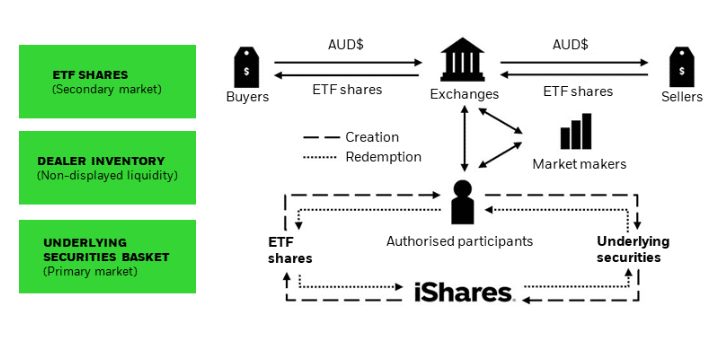

An AP is a financial institution that dynamically manages the creation and redemption of ETF shares in order to help the price of an ETF accurately track the value of its basket of underlying securities.

“That risk is going to be managed by posting collateral, which may be in the vicinity of 105% to 110% of the value,” Hooson added.

Reggie Browne, principal at market maker GTS, highlighted on the webinar that each custodian in the ETF complex requires different levels of collateral.

“It would be nice to have uniformity across custodians about the behavior of funds, the call for collateral and the return of collateral,” he added.

In addition, Browne wants custodians to increase the efficiency of collateral movements. For example, if GTS creates several units of a foreign basket for a US ETF, he should be able to deliver a partial basket for settlement and get some collateral back, but this does not occur consistently across custodians.

“As we move closer to T0, (same day settlement), custodians need to adapt and put systems in place to protect funds, but also be willing to return collateral to reduce the costs to participants across the board,” Browne added.

Automation

Hooson said BBH is working with market makers and APs on the efficient use of collateral, and improving workflows by adding automation, while also protecting the funds.

“We are in the process of building out a T0 create or redeem mechanism for ETFs,” said Hooson. “From a BBH perspective, that is something that we are prepared to support.”

In February this year Citi Securities Services said in a statement it was launching FIX API connectivity on ACES, the bank’s online, global ETF portal that automates the ETF process. The bank said the new integration offers simplified order management and onboarding, and allows APs to connect directly to ACES and manage ETF share creation and redemptions more seamlessly.

Paul Spyropoulos, ETF product manager at Citi Securities Services, said in the statement: “With the ETF industry’s move to T+1 looming around the corner and the push for digitization, this enhancement comes at an opportune time. By integrating ACES with the FIX protocol, we are unlocking scalability and efficiency not only for our clients, but all ETF market participants.”

In the same month BNY Mellon also said in a statement that it is launching its next-generation ETF basket construction platform to provide asset managers with a digital workflow. Asset managers will be able to customize and retrieve ETF baskets via API, as well as access the platform externally through the client gateway to view the workflow and status of outstanding processing exceptions.

Christine Waldron, global head of fund services at BNY Mellon, said in the statement: “Through evolving our technology platform, this ultra-transparent user portal connects market participants to ETFs at any point in the lifecycle and strengthens the broader ETF ecosystem.”

State Street also said in a statement in February this year that its Fund Connect ETF portal is being expanded to cover all clients globally including in Europe and Asia Pacific.

Fund Connect ETF APIs have been available in the US and Canada for years and account for nearly half of North American order volumes according to the firm. Fund Connect ETF is a global online portal that facilitates the creation and redemption of ETFs, designed as a single point of access to many issuers. This enhanced API integration allows clients globally to place orders directly with funds via their own order management systems (OMS).

Frank Koudelka, global head of ETF Product at State Street, said in a statement: “The global API connectivity is the next logical step in the continued digitization of our ETF servicing business. The continued theme we have heard is a desire to communicate system-to-system as opposed to web portals, and Fund Connect is now the first create / redeem portal with fully enabled via APIs across Asia-Pacific, Canada, Europe and the United States.”

Global impact

Antonette Kleiser, ETF specialist at BBH, said in the webinar that T+1 in the US is acting as a catalyst for other jurisdictions to look at their settlement timeframes.

“European investors are more invested in the U.S. than in European or other global markets, so this change is very impactful,” she added. “The European Commission has said that it is a matter of when, not if, that Europe moves to T+1.”

Kleiser continued that the biggest challenge is that misalignment in settlement between the fund and the underlying basket could lead to a breach of European Union UCITS regulation which covers ETFs. There are restrictions around how much cash UCITS ETFs can hold with one entity and how much the fund can be overdrawn.

“There certainly needs to be a focus around security lending processes and workflows, and making sure there is as much automation as possible in order to get securities back on recalls and facilitate settlement,” she said.

Most global portfolios contain a high percentage of U.S. or Canadian securities, so Kleiser expects some will also move to T+1.

“BBH has been monitoring our European book of business and found that over the last year, more than 50% of ETF orders may be currently settling a T+1 basis,” she added.

Hooson highlighted that BBH can already support T+1 settlement in the US ETF market, but this is the exception, rather than the rule.

For example, T+1 may be used to manage inventory so that market makers can meet their secondary market obligations; or it could be part of a portfolio rebalance or some other custom activity.

Kleiser added that BBH already supports T0 for some ETFs in Hong Kong. She said: “It requires pre-funding but it is happening in the ETF environment.”

Browne said his initial concern with the move to T+1 is settlement failures in baskets with a global component, especially with constituents from Asia Pacific. These failures will lead to an increase in costs, which will be passed onto investors.

He is also concerned about the accuracy and posting of baskets and the availability of those securities for trading in the necessary timeframe.

Browne said: “The first few months after T+1 will be bumpy, but the industry will learn, adjust and move onto business as usual.”