Tokenized funds invested in government securities and issued on public blockchains exceed $800m.

Germany’s Deka Investment has become the latest asset manager to issue a tokenized fund as Libre, a tokenization platform for the industry, is being launched.

Larry Fink, chairman and chief executive, said at the New York Times’ DealBook event last year: “I believe the next generation for markets, the next generation for securities will be tokenization of securities. Distributed ledgers will bring instantaneous settlement and change the whole ecosystem.”

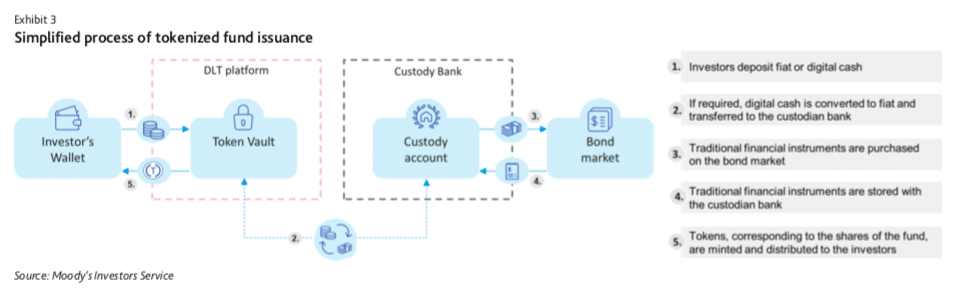

Moody’s Investors Service said in a report on decentralized finance (DeFi) and digital assets in January that tokenized funds are carving out a niche in finance as they raise efficiency. The ratings agency highlighted that in 2023 that there were several issuances of tokenized funds, primarily backed by government securities, such as US Treasury bonds.

“The total amount of tokenized funds invested in government securities and issued on public blockchains has exceeded $800m, experiencing triple-digit percentage growth in the past year.”

Deka Investment has issued shares in a crypto fund on a blockchain for the first time according to a statement from SWIAT, a blockchain developer. Users of the SWIAT blockchain can comply with capital market law and regulations according to the fintech.

Thomas Schneider, Deka Investment

Thomas Schneider, Deka Investment

Thomas Schneider, chief operating officer of Deka Investment, said in a statement: “We want to permeate the process steps along the entire product value chain – from the launch to fund events to fund closure – to be able to launch further funds on the blockchain in the future if there is sufficient demand.”

Deka Group said in its 2022 annual report that digital assets have the potential to make a wide range of investments easier and cheaper for customers to access, to substantially streamline value chains and to overcome the fragmentation of capital markets in Europe. The group said it had a major part in founding SWIAT (Secure Worldwide Interbank Asset Transfer), a company developing a blockchain-based decentralised financial (DeFi) infrastructure.

In 2024 SWIAT wants to bring more partners onto the blockchain to realise the full potential of the ecosystem including real-time settlement and collateral management.

“For example, the digital issuance of shares in mutual funds via the SWIAT platform is conceivable in the future, as is the issuance of e-shares,” added SWIAT. “The German government has already created the regulatory framework for electronic shares with the Future Financing Act.”

SWIAT has forecast that an open DeFI market in Europe will grow more than 60% each year to more than €3 trillion by 2030.

Another example of growth is in Switzerland where Taurus, a regulated securities firm, said in a statement that TDX, its digital asset organized trading facility, is open to retail investors following approval from FINMA, the Swiss regulator. Retail clients can now create an account and trade digital assets and tokenized securities.

TDX has also listed tokenized issues from Swiss companies including Swissroc real estate Group, and lender Teylor. Yann Isola, head of product at TDX: “Our core belief at Taurus is that private markets 2.0 shall be digitized, so that buying a private security becomes as easy as buying a book on Amazon.”

In the UK funds were authorised to develop tokenization in November last year, following the establishment of the Technology Working Group of the Government’s Asset Management Taskforce.

A report, UK Fund Tokenisation – A Blueprint for Implementation, outlined a model for the implementation of tokenization, that can be used within the existing legal and regulatory framework, and which fund managers can implement immediately.

Michelle Scrimgeour, chair of the working group and chief executive Officer at Legal & General Investment Management, said in a statement: “Fund tokenization has great potential to revolutionise how our industry operates, by enabling greater efficiency and liquidity, enhanced risk management and the creation of more bespoke portfolios.”

New tokenization platform

As fund tokenization increases, Nomura’s Laser Digital and fintech WebN said in a statement in January that they are launching Libre, a tokenization platform for the asset management industry which is slated to go live in the first quarter of this year.

They said Libre enables complete fund lifecycle automation, allowing for smaller ticket sizes and provides access to services such as collateralised lending and portfolio rebalancing.

The first investment firms lined up to use the system are Brevan Howard and Hamilton Lane.

Victor Jung, head of digital assets at Hamilton Lane, said in a statement: “We believe that tokenisation has the potential to revolutionise the way investments are managed and traded, and are focused on strategically partnering with other leading firms to improve compliance and streamline access to the private markets through initiatives like Libre.”

Technology risks

Moody’s also warned in its report that the tokenization poses several unique risks, alongside the traditional risks in fund management.

For example, many service providers in tokenization have limited track records, increasing the risk that payments could be disrupted if there is a bankruptcy or technological malfunction; and the potential exposure of the fund collateral to volatile crypto assets.

In particular, public blockchains are particularly exposed to technological risks, cyberattacks, and governance issues.Therefore management of a tokenized fund requires a wide range of expertise, according to Moody’s, in navigating the new technology and diverse regulatory regimes covering both the location of the fund’s issuance and potential investors.

Moody’s said crypto investors may lose interest in tokenized funds if rising yields on government bonds do not compare favorably to returns in volatile crypto markets.

“This attraction could diminish, though, if there is another bull cycle in the crypto market, in which case tokenized fund managers may need to redirect their attention to traditional investors,” added the report.