MarketAxess is aiming to initially launch Adaptive Auto-X in the first half of this year to provide clients with algorithmic workflows and allow them to make best use of the firm’s various liquidity pools.

Chris Concannon, president and chief operating officer at MarketAxess, laid out plans for Adaptive Auto-X on the 2022 full-year earnings call on 25 January for the firm which operates a fixed income electronic trading platform and provides market data and post-trade services.

Auto-X allows buy-side clients to automate the submission and execution of request for quote (RFQ) orders. When spreads widen, Auto-X automatically adapts to make sure trades are occurring within the market context and questionable trades are sent back to the human trader to be evaluated. Adaptive Auto-X is another step in automation which connects multiple trading protocols available via Open Trading, MarketAxess’ all-to-all trading model.

Concannon said: “In the first half of this year, we will have an initial launch of our Adaptive Auto-X solution, which will provide algorithmic workflows for clients to systematically access broader liquidity across multiple trading protocols. This new service is expected to unlock additional cost savings for clients while simplifying client workflow.”

Gareth Coltman, head of automation at MarketAxess, told Markets Media that when clients approach execution today, they have a decision tree in terms of what they are going to do with an order – send it out immediately, try to tap into advertised natural liquidity or use a new protocol.

“Adaptive Auto-X allows them to replace a relatively clunky manual process and systematise that multi-step, multi-decision workflow so that it is powered by data,” he said.

At its heart, Adaptive Auto-X is an algo and smart order router that allows clients to draw on MarketAxess’ predictive AI-driven analytics like CP+ and direct their order to achieve whatever workflow they specified in order to create better quality execution outcomes, according to Coltman. Clients can predefine, customise and parameterise those workflows to meet the specific needs of each trading desk.

He described Adaptive Auto-X as a work in progress. MarketAxess talking to clients about the product, showing them the product in its early form and hoping to start a pilot later this year.

“Adaptive Auto-X is going to be a huge part of what we are working on with clients this year and beyond,” Coltman added. “It brings together protocols, styles of trading and liquidity pools into one place for clients, and helps them navigate the market by using our predictive analytics to better inform trading decisions and achieve better execution outcomes.”

Clients tell MarketAxess that their biggest pain points are increasing cost pressure, the need to scale efficiently and for traders to be able to consume actionable data and get access to liquidity in a very easy way. Therefore, the firm’s ambition is to be able to provide all its liquidity, data tools, and connectivity through a single interface.

Automation

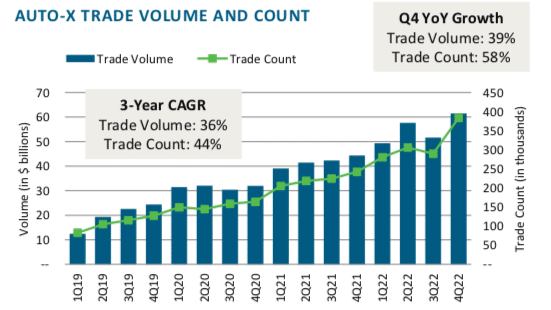

For 2022 MarketAxess reported a record $62bn in Auto-X volume, up 39% year-on-year. A record 383,495 trades were completed using automated execution, which represented an increase of 58%.

Coltman said that over the past 12 months the industry has experienced a challenging and volatile market, but automation has grown every quarter as clients have continued to roll out automation across their trading desks and workflows to gain efficiency.

“We see our largest clients adopting automation in a big way and are beginning to embed it in every aspect of their workflow,” he added. “Some are using it for between 80% and 90% of their trades and we have also seen growth in the number of mid-size firms adopting automation.”

MarketAxess automated approximately 1.3 million transactions for clients last year, up from about 600,000 in 2020, and Coltman said no-touch story is part of that automation journey. The firm reported that a record 36% of automation trades were “no-touch” in 2002, up from 27% in the previous year.

“For our clients around a third of trades are no-touch, up from less than 10% two years ago, so that has been a significant trend,” he added. “No-touch is the pinnacle of efficiency and clients are growing in confidence about what is possible, the depth of liquidity and the controls they have to manage execution risks.”

Another trend that Coltman highlighted is that clients are starting to increase the maximum order size that they automate. In addition, Marketaxess expanded the product range that can be automated by launching in municipal and local emerging markets last year.

Coltman said: “There is clearly an appetite for automation, and we have developed a toolset which adds value to each client in their stage of that journey. Adaptive Auto-X is the next natural step in that process.”

Concannon said on the results call that Auto-X represents 20% of total trade count and 8% of credit trading volume. Investment grade has seen the highest adoption of electronic trading and high-yield is growing rapidly.

“If you look at emerging markets, the opportunity is one of the largest opportunities globally,” he added.

Concannon continued that municipal bonds are probably in the most need of electronic adoption, particularly given the size of the average ticket. As a result Marketsaxess had a record year of electronic adoption in munis.

MarketAxess clients trade across the fixed income landscape and Concannon expects that electronic trading can reach the 90% rate that is seen in other asset classes. He said: “In the electronic adoption evolution you get to a point where you have to go all the way, not just part of the way, and your workflows become fully automated and fully electronic.”

The use of dealer algorithms also continues to grow across the MarketAxess platform.

“Clients are increasingly facing higher ticket counts and smaller trade sizes while trying to manage their technology costs,” he said. “Our automation tools are increasingly in demand to help address these growing challenges.”