SEC has set an implementation date of May 28, 2024.

There is just one year left before the standard settlement cycle for most US broker-dealer transactions in securities will be reduced from two business days after a trade, T+2, to T+1.

In February this year the Securities and Exchange Commission adopted final requirements for a 28 May 2024 implementation date, which is earlier than anticipated. The regulator said the change will reduce latency, lower risk, promote efficiency and greater liquidity in the markets.

Valentino Wotton, head of institutional trade processing at the Depository Trust & Clearing Corporation, the post-trade infrastructure, said in an email that market participants should already have preparations under way in order to provide sufficient time for industry-wide testing.

He added that the volume of changes being implemented to support the move to T+1 in the U.S and the number of firms making changes requires testing to be coordinated across many touchpoints to ensure readiness.

“To meet the accelerated settlement timeframe, it is critical that market participants eliminate manual processes and maximise automation in the post-trade pre-settlement space,” said Wotton. “Specifically, the SEC highlighted that institutional trades must be allocated, confirmed and affirmed as soon as is technologically possible and no later than trade-date, referred to as same day affirmation.”

Wotton stressed that that automated solutions to help market participants achieve same day affirmation already exist and switching from manual to automated processes for allocation, confirmation, and central matching significantly reduces the number of post-trade exceptions.

“Trade affirmation and instruction for settlement can be fully automated when a centrally matched trade between an investment manager and executing broker occurs, eliminating the need for either party to take further action,” he added.

Automation

There is already evidence of increased automation being implemented before the T+1 implementation date.

For example, DTCC has announced a collaboration to provide automated central matching capabilities for cash securities transactions in Japan with Nomura Research Institute, which provides services to the country’s financial services firms. Regional firms in Japan will be able to use CTM, DTCC’s platform for the central matching of cash securities transactions, directly from NRI’s SmartBridge Advance offering to streamline and enhance the post-trade process, enabling users to achieve a shorter time to settlement and increased efficiency.

Wotton said in a statement: “Achieving faster time to settlement for both cross-border and domestic transactions is now more important than ever, as firms around the world prepare for the U.S. move to T+1.”

In Canada, exchange operator TMX Group and Clearstream Banking, the international central securities depository of Germany’s Deutsche Börse Group, are planning to launch an automated Canadian Collateral Management Service (CCMS) which will include the introduction of Canada’s first domestic triparty repo capability.

Sam Riley, chief executive of Clearstream Securities Services, said in a statement: “CCMS will deliver increased liquidity and efficiency while minimizing exposures, supporting the Canadian market on its endeavor to move to T+1. Clients will also benefit from Clearstream’s industry-leading technology and digital innovation, such as the cloud-based, digital collateral schedule capability known as OSCAR.”

The service is slated to launch in the third quarter of this year. The first phase will be offered to market participants in Canada’s secured funding market to provide an automated and efficient process throughout the transaction cycle.

Impact on foreign exchange

The Global Financial Markets Association highlighted that accelerating U.S. securities settlement raises the risk that transaction funding dependent on FX settlement may not occur in time.

Foreign investors in U.S securities denominated in U.S. dollars execute FX trades to fund the purchase or sale from their local currencies.

The GFMA explained in a report, FX Considerations for T+1 U.S. Securities Settlement, that cross-border U.S. security transactions with a related FX trade will require the expedited execution of both trades to enable settlement to be completed in the shortened T+1 window. The FX settlement process, which involves trade matching, confirmation, and payment, will all need to be completed within local currency cut-off times.

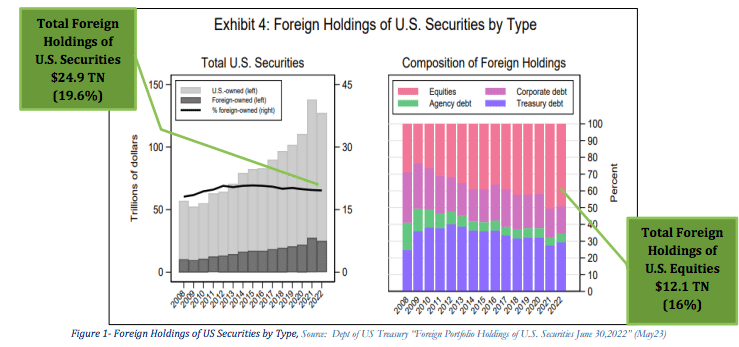

The impact of T+1 on FX is important because the overseas ownership of US securities is 19.6%, and 16% of the equity market according to the report.

The report warned that the acceleration of the U.S. securities settlement cycle to T+1 raises the risk that security transaction-funding, dependent on FX settlement, may not occur in time.

“Closer coordination of the timing and settlement for both the security and FX trade is needed to ensure there is adequate time available for the settlement and payment of FX trade for the T+1 security transaction,” added GFMA.

For example, a UK fund manager buying a U.S. equity will not know the exact amount of US dollars they need to purchase until the equity trade is done, which could be during the close at 4pm EST/9pm London. The asset manager would cover the currency the following morning to ensure the US dollars are paid to their counterparty that day which could cause a problem if there is a need to correct any errors in the trades.

There is added complexity for Asian-based fund managers trading US securities due to the time difference, and as some emerging and frontier market currencies may also have local currency controls. Therefore, some transactions may need to be pre-funded which increases the cost of trading.

“Consideration should be given to the benefits of improving operational efficiencies, including investment in technologies that focus on the increased automation of processes, and to assessing the viability of using third-party vendors,” added GFMA.

The association also predicted that trading platforms could see an increase in demand for multi-asset trading and settlement capabilities.

“Simultaneous execution and increased process automation of equity and currency trades in tandem will assist in expediting the confirmation and settlement process required to meet the T+1 deadline,” said the report.

GFMA recommended the institutional buy-side market participants may consider outsourcing their currency management to specialists with trading/operations in the major trading time zones and 24/5 market access to wholesale FX pricing and liquidity management to assist with best execution.