Leo Melamed has managed to squeeze in a markets career in between penning interplanetary thrillers.

This article first appeared as FLASH FRIDAY on Traders Magazine, a Markets Media Group publication. FLASH FRIDAY is sponsored by Instinet, a Nomura company.

The founder of financial futures is writing another book.

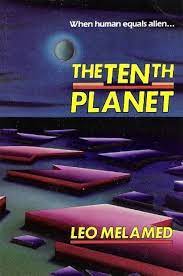

Leo Melamed’s next novel, due out later this year, isn’t about interest rates, currencies or equity indices. Rather, it’s the sequel to The Tenth Planet, Melamed’s 1987 interplanetary thriller about an earth space probe that is discovered by an advanced alien civilization.

“My interest in sci fi is age-old,” said Melamed, spry and affable at age 92. “The Tenth Planet was the result of NASA’s 1972 launch of Pioneer 10, a space probe that was destined for Jupiter and was the first to escape our Solar System. Carl Sagan believed it might be found by intelligent beings and created a Message Plaque to identify us. In my story, the space probe is found.”

Melamed, currently Chairman Emeritus of CME Group and CEO of Melamed & Associates Consulting, sat down with Traders Magazine on March 12 over a bagel, coffee and orange juice on the sidelines of the International Futures Industry Conference in Boca Raton, Florida. The wide-ranging discussion, and a follow-up email exchange, covered his career, the futures powerhouse that is CME Group, today’s market and technology landscape, and of course, his love of sci-fi.

Melamed’s backstory is well known, and it is one of the more remarkable ones in the industry.

Born in Poland in 1932, his family fled the Nazis in 1939 at the outbreak of World War II, first to Lithuania and then to Japan, before settling in Chicago in 1941. The Windy City would play a central role in Melamed’s life, as it’s where he raised a family and stumbled into a job in the early 1950s as a produce futures runner on the Chicago Mercantile Exchange.

Safe to say it worked out. Melamed ascended to become Chairman of the Merc in 1969 and soon after drove the creation of a number of financial futures contracts, including US Treasury bills, Eurodollars, and stock index futures. CME Group is now a $78 billion publicly traded global company comprising four independent exchanges: Chicago Mercantile Exchange (CME), The Chicago Board of Trade (CBOT), the New York Mercantile Exchange (NYMEX), and the Commodity Exchange (COMEX).

“I created an institution that covers the entire waterfront of finance, which I’m very proud of,” Melamed said. “And I didn’t take any stake for myself. I didn’t personally gain anything except for reputation.”

In 1987, in the heyday of clamorous elbow-to-elbow floor trading, Melamed spearheaded the creation and introduction of the Globex electronic trading system. As a result, he said he received death threats and had to hire a Chicago police officer for personal security.

Melamed identified the rising popularity of Nintendo and other home video game systems among young people at the time, as a harbinger of a broader trend toward electronification. “The hardest thing I ever did was acting on my belief … I had to stare down 3,000 traders with the idea of going electronic.”

“I told them you may not like it, we’ll lose some jobs, but ultimately technology always adds more than it takes away,” said Melamed. “Plus, if we don’t go electronic, someone else will. Usually the first mover wins. Second and third get pieces, but they won’t win.”

“Because we had Globex we are what we are today: the biggest and most efficient exchange in the world.”

Melamed said a testament to CME’s strength was when the exchange opened for business as usual on Monday, September 15, 2008, the morning after the cataclysm of Lehman Brothers’ bankruptcy filing. “That tells you everything you need to know,” he said. “The system is so vibrant, deep, and well-organized … That kind of strength is unbeatable.”

The strength of CME lies in the security of its clearinghouse, which Melamed incredulously said one unnamed executive wanted to sell years ago. “The talk these days is about every firm doing its own clearing. To that I say absolutely not. I don’t trust anyone except the exchanges themselves.”

Regarding today’s hot technology – artificial intelligence – Melamed is bullish overall. “In any area that has a data history of many years, AI can do a great deal of work and be a great benefit to mankind.” But he expects AI will have a minimal impact on trading and the direction and efficiency of markets. “The human brain is still the greatest computer.”

To the question of what he does currently, Melamed said: “Of course I still trade, it is in the DNA.”

“Further, I remain an advisor in the IAC, the Chinese Advisory Council, a prestigious forum on which I have served for many years. I also remain chairman of the CMAC, the CME’s Competitive Market Advisory Council, a think tank I created with Nobel Laureate Myron Scholes for the Merc back in 2008, composed of several Nobel Laureates and other financial authorities, who meet twice a year to discuss topics relating to markets; our last meeting was a discussion on Artificial Intelligence. It is also the forum that chooses the recipient of the annual Melamed-Arditti Innovation Award.”

In the meanwhile, look out for Cousins, the sequel to The Tenth Planet. Melamed didn’t give away much about the plot other than hinting at an unexpected connection.

“Science fiction has no boundaries,” Melamed said. “When I published my novel, some people said they weren’t surprised about my science fiction bent, since that is what I was doing for futures markets.”