New settlement protocol is expected to boost institutional interest.

Two Swiss digital bonds have settled on blockchain-based SIX Digital Exchange (SDX) using a wholesale central bank digital currency from the Swiss National Bank, which is expected to boost institutional interest.

The City of Lugano and the City of St. Gallen each raised CHF 100m through digital bonds which were successfully issued and settled on SDX, the digital asset arm of SIX Swiss Exchange, on 7 and 8 March 2024. The bonds are dual-listed, providing access to trading on both SDX and SIX Swiss Exchange, and can be held and settled in the central securities depositories of both SDX and SIX.

We are excited to announce that the #digitalbonds of the City of Lugano (CHF 100m / ISIN: CH1319968462) and the City of St. Gallen (CHF 100m / ISIN: CH1331113444) were successfully issued and settled on the production platform of #SDX on 7 and 8 March 2024.

This achievement… pic.twitter.com/UzUivLAQD6

— SIX Digital Exchange (@SDX_global) March 11, 2024

David Newns, head of SDX told Markets Media, that it was a prerequisite for the natively issued digital bonds to also be held and traded on traditional financial market infrastructure, and move seamlessly between the two ecosystems in order to attract more investors.

“Building a bridge between digital assets and traditional finance is really important to facilitate the migration and adoption of the technology with regulated counterparties who provide services in a transparent, efficient and trusted way,” he added. “2024 will be the year of real institutional adoption of digital assets.”

In January last year the City of Lugano issued the first public sector digital bond on a fully regulated digital platform when it sold a CHF 100m bond that was listed and tradeable at both SIX Swiss Exchange and SDX, but that was not settled using a wholesale central bank digital currency.

Paolo Bortolin, deputy chief financial officer of the City of Lugano, told Markets Media in an email that the latest bond issue is particularly significant because it is part of the Helvetia III project led by the Swiss National Bank.

“This means that the settlement of this new digital bond was conducted using a real wholesale central bank digital currency (wCBDC),” he said. “It’s truly a historic bond.”

The City of Lugano said it is the first city in Switzerland to issue a digital bond with wCBDC settlement, and it is currently the only debtor on the Swiss capital market with two outstanding digital bonds.

Bortolin added that the Helvetia III project, which began last year and will conclude in June this year, also includes digital bonds issued in December 2023 from the Canton of Basel Stadt and the Canton of Zurich.

Paolo Bortolin, City of Lugano

Paolo Bortolin, City of Lugano

“The City of Lugano intends to stimulate the public sector to also innovate in the financial sector and supports this new issuance method, which is the digital evolution of the traditional one,” he added.

Todd McDonald, co-founder and chief strategy officer at R3 told Markets Media that the enterprise distributed ledger technology and services firm has been working with central banks on CBDCs in a step-by-step process since 2016.

“The Swiss National Bank has been a leader in progressing this in a very orderly way, and thinking it through specifically for wholesale markets and securities settlement,” added McDonald. “The architecture of SDX means they are able to have an end-to-end digital lifecycle inclusive of settlement into near central bank digital currency.”

Newns said that as more transactions are settled using wholesale central bank digital currency, using digital bonds will become almost standard.

“SDX tripled its membership in 2023 which has led to more confidence around the issuing digital bonds on the platform and more issuers,” Newns added. “I think we have certainly shown that there is no downside, only upside, although the migration of the entire ecosystem is going to take a long time.”

Delivery versus payment

McDonald hopes that the Swiss authorities can bring this facility online permanently after the Helvetia III project is complete.

“It is important for the whole market that we work together to bring a digital delivery versus payment to reality, where that is through a single ecosystem like SDX or across multiple networks and ecosystems.”

He is optimistic that issuance of digital bonds is moving beyond one-off tests to becoming a normal way of doing business. McDonald added: “I hope it just becomes boring. Digital issuance has been held back by how to make it fit more seamlessly into how business is done today.”

In another real use case, the World Bank issued a €100m digital bond, which marked the launch of Euroclear’s digital securities issuance (D-SI) service in October last year.

The D-SI service enables the issuance, distribution and settlement of fully digital international securities on distributed ledger technology, in this case R3’s enterprise platform Corda, in compliance with the European Union’s central securities depository regulation. Euroclear’s digital financial market infrastructure is connected to the traditional settlement platform to allow investors full access to trading venues and liquidity management facilities.

Atomic settlement, instantaneous delivery versus payment enabled by a distributed ledger, is at the top of the agenda of the European Central Bank, according to McDonald, and there are also other initiatives around the world. For example, R3 is doing a lot of work in the Gulf.

He continued that customers’ concerns around atomic settlement are focused around whether the technology works, whether the business case holds and how it fits into their legal and regulatory framework.

“This last part is incredibly important,” McDonald added. “Something new, like a digital bond, has to meet those three concerns but also potentially improve the environment.”

McDonald also highlighted the importance of regulators such as the Bank for International Settlements (BIS) and MAS in Singapore driving a unified global ledger to avoid fragmented silos of liquidity and technology.

“We don’t think that it is realistic that everyone is going to opt into a single network so we should embrace a network of regulated networks,” he added. “We are very committed to the interoperability of regulated networks.”

An example of global cooperation is the launch of the Singapore-based AsiaNext digital asset exchange, a joint venture between Japan’s SBI Digital Asset Holdings and SIX Group to provide an institutional-grade, end-to-end digital assets value chain for institutional investors.

AsiaNext launched crypto derivatives trading at the start of this year and aims to provide a broad product pipeline including digital securities, tokenized real-world assets and sustainability-focused listings. Jos Dijsselhof, chief executive of SIX, said in a statement that the future of finance is in bridging the gap between traditional capital markets and digital ecosystems, with institutional adoption of digital assets emerging as a key pathway.

Newns said: “The long-term term vision is that we are building global liquidity pools based on blockchain and a corridor between Singapore and Switzerland.”

Tokenization

McDonald noted that digital bonds can improve an existing market, but digital securities also have the potential to unlock liquidity or create new asset types through tokenization, especially in private markets.

Tokenization 1.0 = institutions experimenting

Tokenization 2.0 = institutions onchain

Tokenization 3.0 = composable and aggregated

"digitally native" is the bridge from 2.0 -> 3.0

In other words, a MASSIVE unlock. https://t.co/Q3RrQAsm0V

— Colin Butler (@RealCryptoColin) March 8, 2024

Once a security is in the form of a token, a smart contract on a blockchain, it becomes much easier to trade and use as collateral which will lead to acceleration of digital markets.

“You are going to start to see collateral mobility as the next big area in digital markets,” McDonald added.

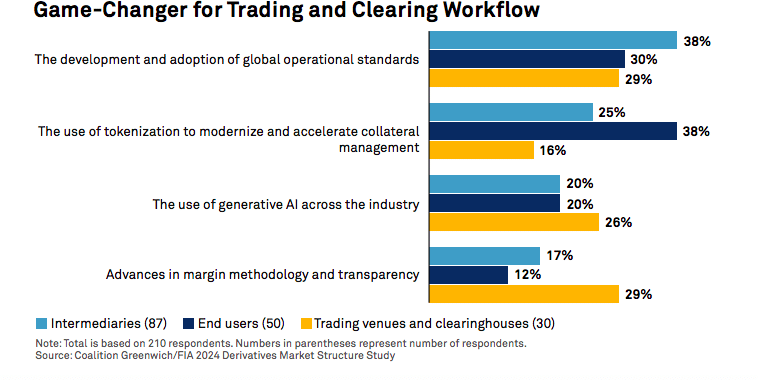

For derivatives end users, tokenization was the biggest potential game-changer for the trading and clearing workflow according to a survey from Coalition Greenwich.

The consultancy’s report, Derivatives Market Structure 2024: Focusing on Capital and Workflow Efficiency, said tokenization is at a very early stage of development, but many large asset managers are testing the potential for using this technology to move cash and securities more efficiently.

Coalition Greenwich added: “From their perspective, the transformation of financial assets into tokens and the use of distributed ledgers to manage transfers could lead to a substantial reduction in time and expense.”

Project Helvetia Phase III is also due to extend to the settlement of repo transactions. Transactions in the test environments will be collateralized by digital bonds eligible for Swiss National Bank repo transactions and settled on SDX in wholesale central bank digital currency.

“I think this is a very impressive testament to the SNB that they are pushing the edges of the space and really testing out what you can do with the technology, and the implications for operations, and most significantly, the governance of central bank money in the context of blockchain and tokenization,” added Newns.

SDX is also working on collateral mobility with its regulated blockchain-based central securities depository.

“We are very excited about this year in terms of showing that we can support more value-added use cases on our blockchain infrastructure,” said Newns. “I am very much looking forward to the findings of Project Helvetia Phase III, more bond and equity issuances on the platform and increasing the number of SDX members.”