The securities industry is making significant technological strides. Where are firms progressing and what’s holding them back?

By Monica Summerville, Head of Capital Markets, Celent

As the financial marketplaces of the future come into view, so does the evolution of technology in use by the securities industry. Securities firms’ digital transformation will revolve largely around developments in three key areas: cloud adoption, mainframe modernization, and the ways firms leverage data exchange mechanisms.

The Celent report Preparing for a Cloud-Enabled, Data Driven World highlights findings of analyst-led interviews (conducted in 4Q21 and 1Q22) and surveys with 28 technology and operations executive leaders across 19 North American financial institutions (FIs). DTCC, a financial services company that provides clearing and settlement services for the financial markets, commissioned Celent to conduct research to provide an overview of industry progress on its transformation journey. Analysis of this research illustrates significant takeaways for chief information officers (CIOs), chief information security officers (CISOs), chief risk officers (CROs), and line of business heads (LOBs heads) across capital markets firms on the buy and sell side, as they evaluate the parallel technology structures necessary for full digital transformation.

- Cloud Adoption

The study found cloud adoption is almost universal within the securities industry. Top drivers for cloud adoption (for both the buy and sell sides) are: increasing business agility, increasing operational efficiency, and improving security and resilience. The previous focus on infrastructure-as-a-service (IaaS) and “lifting/shifting” to the cloud is changing; firms recognize that gaining the true benefits of cloud requires the full embrace of cloud technologies and new ways of workings. Cloud-native and cloud-first (meaning new applications are built as cloud native) approaches are now widespread across FIs in the securities and investment management space.

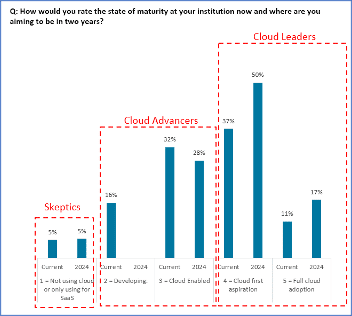

The degree to which any individual FI embraces cloud, however, varies. Nearly 50% of all study participants may be described as “cloud leaders.” This cohort already have or are moving toward a fully cloud-native stack; their new application development utilizes cloud native technologies and modernizing legacy applications is a priority. Most cloud leaders work with multiple public cloud vendors but the study found AWS and MS Azure together dominate market share in the capital markets industry.

In the coming two years, many firms will move toward widescale hybrid private/public cloud-first adoption. By 2024, about one-quarter (28%) of firms will be cloud advancers, deploying some applications in public and private clouds, while also maintaining on-premises infrastructure. The retention of on-premises computing is often for use cases where latency, performance, or data privacy are prioritized, but where the FI lacks comfort with public cloud or the necessary in-house expertise. The number of cloud leaders with “cloud first” adoption is expected to grow from 37% of firms today to 50% by 2024

Finally, a minority of securities firms remain as skeptics, showing no interest in migrating to public cloud. External data sharing, cost, the need for high performance compute, and concerns around cloud service provider (CSP) lock-in are among the top reasons that the skeptics shy away from moving to the cloud.

While approaches to cloud strategy vary, most take a federated approach, with a core central center of excellence (COE). The COE, which is aligned with the architecture team, functions as an expertise and advisory center, offering flexibility for business technology teams.

- Mainframe Modernization

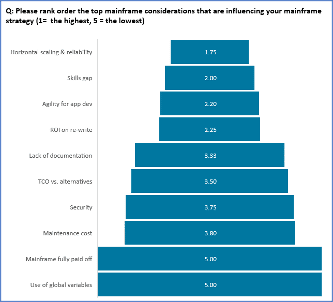

The gap is closing between cloud and older computing platforms, including the mainframe computer. Mainframes remain prevalent across capital markets, with more than 50% (and 44 of the top 50 banks) still using a mainframe. Slightly more than half (56%) plan to retire their mainframe, a process that will take five or more years; the other 44% will maintain and modernize it. The top considerations for strategic decisions about mainframe focus on scaling, the skills gap (which may be both a technology/resourcing issue and a business risk), and app development agility.

Perhaps the number of firms that are maintaining their mainframes is surprising, but reliance on mainframes comes from their remarkable functionality as workhorses, performing with reliability, security, and speed. Because the mainframe plays an ongoing role in supporting core processing, it isn’t likely to disappear. Instead, tech advances (i.e., mainframe containerization) address historical core concerns, facilitating the support of modern applications by mainframe.

- Data Exchange and Data Management

The area showing the greatest potential for transformation is around data exchange mechanisms. Being a digitally-enabled, data-driven organization enables adoption of artificial intelligences (AI) approaches, including machine learning (ML), natural language processing (NLP), and deep learning.

Today, AI and the pivotal area of data area are approaching significant change. Broad enablement of data for insight requires effective enterprise data management; firms still have significant work to complete around the areas of data exchange and data management in order to deliver on this possibility. Given this need, it comes as little surprise that most firms (50%) self-identify as being in the “early days” of AI adoption firm-wide; 17% report that they’re in the process of building expertise with AI, and 33% say that AI has been widely adopted. Typical use of AI is currently on discrete (even mundane) areas, not on enterprise use cases. Meanwhile, firms are evaluating a wide range of types of AI, such as NLP for chatbot development, robotic process automation (RPA) for post-trade workflows, and optical character recognition (OCR).

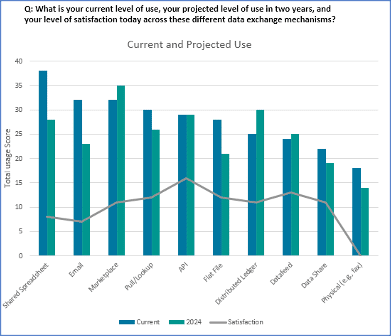

Manual and batch-based methods of data exchange hamper some data initiatives, but progress is expected in the coming two years, when methods of real-time data transfer/exchange will dominate. Top drivers around data exchange efforts include timeliness and client expectations/business drivers (both cited by 23% of respondents) and reliability and agility (tied at 14%). Growing reliance on data marketplaces, distributed ledger technology (DLT), and application programming interfaces (APIs) are among the data-related technology approaches receiving heavy promotion.

Investment and adoption of APIs is expected to increase, as they received the highest rating regarding customer satisfaction, when compared against a range of data exchange mechanisms ranging from more advanced approaches (like DLT and datafeed) to legacy mechanisms (including manual approaches, like fax). APIs have the ability to enhance clients’ experience through improved access to functionality or to data on a frequency that is convenient to the client.

Move Beyond Hurdles

Securities firms face persistent challenges as they embrace new technologies. For cloud initiatives, concerns include the expense of moving data in and out of the cloud; storing data in the cloud without clear control of global location can also hit regulatory hurdles related to data privacy and sovereignty. For mainframe initiatives, the total cost of ownership (TCO) requires careful consideration of factors related to deployment models; the benefits (for availability, reliability, and security) may justify the expense of modernizing and retaining a mainframe rather than retiring it.

When it comes to data exchange, full migration to contemporary data exchange methods is gridlocked due to the necessity of supporting clients who cling to older approaches. The poor condition of data estates is preventing AI development. While data exchange is promising, the business case for true transformation in this area will require cross-industry coordination, along with management of concerns about data privacy.

Successful technology transformation within securities relies on understanding these hurdles, embracing modern approaches, and making effective investments in technology innovation, firm-wide. Digital transformation necessitates moving beyond legacy technology estates to focus on client-centricity and client enablement.