Colm Kelleher, chairman of UBS, said the bank will downsize Credit Suisse’s investment bank after its acquisition of the rival Swiss bank.

Kelleher said in a press conference on 19 March that a framework of support has been agreed with the Swiss regulators, which ensures a successful “integration” in the best interests of Switzerland and protects shareholders. The deal is not subject to shareholder approval, and is awaiting final regulatory approvals which he said should take weeks or months.

He added: “This transaction confirms and augments our strategy of growing our capital-light businesses. Let me be very specific, UBS intends to downsize Credit Suisse’s investment banking business and align it with our conservative risk culture.”

UBS intends that the combined investment banking businesses will, over time, account for no more than 25% of the group’s risk weighted assets. Kelleher stressed that UBS has a capital light model and will be derisking the investment bank in order to focus on its model of asset and wealth management. He said the combination of the two banks will further strengthen UBS’s position as a leading global wealth manager with more than $5 trillion in assets operating in the most attractive growth markets according to Kelleher.

“Having been chief financial officer during the last global financial crisis, and well aware of the importance of a solid balance sheet, especially in challenging times like these, a new UBS will remain rock solid,” he added .

Ralph Hamers, chief executive of UBS, will be group CEO of the combined entity and Kelleher will continue in his role as chairman.

“I am pleased that this transaction will bring the long desired stability for the Credit Suisse client base,” Kelleher added. “We’re well aware that the coming weeks and months will be difficult for many, especially for the employees. Let me reassure you that we will do our utmost to keep this time of uncertainty as short as possible.”

Axel Lehmann, chair of Credit Suisse, said in the press conference that it was a historic moment and a sad and very challenging day for Credit Suisse. He continued that Ulrich Körner, chief executive of Credit Suisse, took on the role about seven months ago, and despite his leadership team achieving many of their objectives, they did not have time to conclude the project.

He described the massive outflows of client deposits in October last year as a huge downturn. However, Credit Suisse managed to overcome the loss of confidence and started 2023 with a lot of enthusiasm and energy. However, it could not overcome the loss of confidence a second time.

“The downward spiral and the situation over the last few days made it clear that Credit Suisse cannot exist in the same way going forward,” added Lehmann. “The decisions were not easy but the solution presented is the best possible under the current circumstances.”

Lehmann said the firm has a clear focus on its 50,000 employees, of which 17,000 are in Switzerland. Kelleher said it was far too early to comment of job losses, but there will also be opportunities in the new firm.

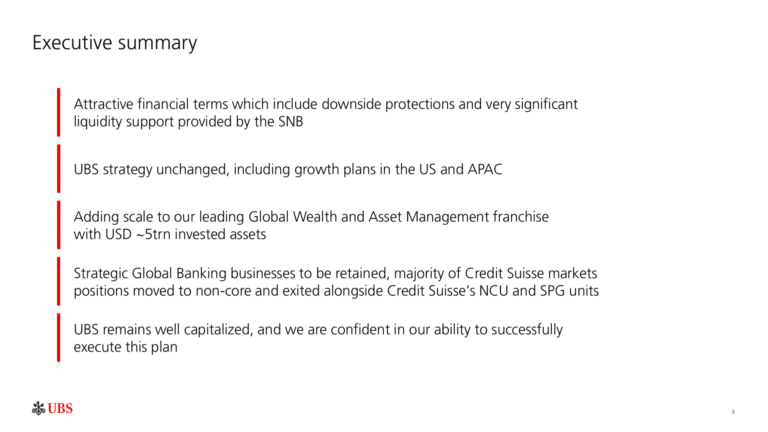

UBS statement: Transaction creates significant sustainable value for UBS shareholders

- Creates leading global wealth manager with USD 5 trillion of invested assets across the Group

- Extends UBS lead in Swiss home market

- UBS strategy unchanged, including focus on growth in Americas and APAC

- Attractive financial terms which include downside protection

- Annual run-rate of cost reduction of more than USD 8 billion expected by 2027

- UBS remains strongly capitalized well above our target of 13% and committed to progressive cash dividend policy

- A focused Investment Bank, remaining committed to UBS’s model; strategic Global Banking businesses to be retained, majority of Credit Suisse markets positions moved to non-core

UBS plans to acquire Credit Suisse. The combination is expected to create a business with more than USD 5 trillion in total invested assets and sustainable value opportunities. It will further strengthen UBS’s position as the leading Swiss-based global wealth manager with more than USD 3.4 trillion in invested assets on a combined basis, operating in the most attractive growth markets.

The transaction reinforces UBS’s position as the leading universal bank in Switzerland. The combined businesses will be a leading asset manager in Europe, with invested assets of more than USD 1.5 trillion.

UBS Chairman Colm Kelleher said: “This acquisition is attractive for UBS shareholders but, let us be clear, as far as Credit Suisse is concerned, this is an emergency rescue. We have structured a transaction which will preserve the value left in the business while limiting our downside exposure. Acquiring Credit Suisse’s capabilities in wealth, asset management and Swiss universal banking will augment UBS’s strategy of growing its capital-light businesses. The transaction will bring benefits to clients and create long-term sustainable value for our investors.”

UBS Chief Executive Officer Ralph Hamers said: “Bringing UBS and Credit Suisse together will build on UBS’s strengths and further enhance our ability to serve our clients globally and deepen our best-in-class capabilities. The combination supports our growth ambitions in the Americas and Asia while adding scale to our business in Europe, and we look forward to welcoming our new clients and colleagues across the world in the coming weeks.”

The discussions were initiated jointly by the Swiss Federal Department of Finance, FINMA and the Swiss National Bank and the acquisition has their full support.

Under the terms of the all-share transaction, Credit Suisse shareholders will receive 1 UBS share for every 22.48 Credit Suisse shares held, equivalent to CHF 0.76/share for a total consideration of CHF 3 billion. UBS benefits from CHF 25 billion of downside protection from the transaction to support marks, purchase price adjustments and restructuring costs, and additional 50% downside protection on non-core assets. Both banks have unrestricted access to the Swiss National Bank existing facilities, through which they can obtain liquidity from the SNB in accordance with the guidelines on monetary policy instruments.

The combination of the two businesses is expected to generate annual run-rate of cost reductions of more than USD 8 billion by 2027.

UBS Investment Bank will reinforce its global competitive position with institutional, corporate and wealth management clients through the acceleration of strategic goals in Global Banking while managing down the rest of Credit Suisse’s Investment Bank. The combined investment banking businesses accounts for approximately 25% of Group risk weighted assets.

UBS anticipates that the transaction is EPS accretive by 2027 and the bank remains capitalized well above its target of 13%.

Colm Kelleher will be Chairman and Ralph Hamers will be Group CEO of the combined entity.

The transaction is not subject to shareholder approval. UBS has obtained pre-agreement from FINMA, Swiss National Bank, Swiss Federal Department of Finance and other core regulators on the timely approval of the transaction.

Credit Suisse statement

Credit Suisse and UBS have entered into a merger agreement on Sunday following the intervention of the Swiss Federal Department of Finance, the Swiss National Bank and the Swiss Financial Market Supervisory Authority FINMA (FINMA). UBS will be the surviving entity upon closing of the merger transaction. Under the terms of the merger agreement all shareholders of Credit Suisse will receive 1 share in UBS for 22.48 shares in Credit Suisse. Until consummation of the merger, Credit Suisse will continue to conduct its business in the ordinary course and implement its restructuring measures in collaboration with UBS. The Swiss National Bank will grant Credit Suisse access to facilities that provide substantial additional liquidity. On March 19, 2023, Swiss Federal Department of Finance, the Swiss National Bank and FINMA have asked Credit Suisse and UBS to enter into the merger agreement. Pursuant to the emergency ordinance which is being issued by the Swiss Federal Council, the merger can be implemented without approval of the shareholders. The consummation of the merger remains subject to customary closing conditions.

Credit Suisse and UBS have entered into a merger agreement on Sunday with UBS being the surviving entity. After negotiations that took place during the weekend leading up to the signing of the merger agreement, UBS and Credit Suisse concluded that it would be in the best interest of their shareholders and their stakeholders to enter into the merger. This move comes after the Swiss Federal Department of Finance, the Swiss National Bank and FINMA asked both companies to conclude the transaction to restore necessary confidence in the stability of the Swiss economy and banking system.

The merger transaction provides for the following key terms:

- All shareholders of Credit Suisse will receive 1 share in UBS for 22.48 shares in Credit Suisse as merger consideration. This exchange ratio reflects a merger consideration of CHF 3 billion for all shares in Credit Suisse.

- The merger transaction remains subject to customary closing conditions. Both parties are confident that all conditions can be met. The merger is expected to be consummated by end of 2023 if possible.

- The Swiss National Bank will grant Credit Suisse access to facilities that provide substantial additional liquidity.

- For the purpose of a seamless integration of Credit Suisse into UBS, UBS is expected to appoint key personnel to Credit Suisse as soon as legally possible.

- Credit Suisse continues to operate in the ordinary course of business and implement its restructuring measures in collaboration with UBS.

- UBS has expressed its confidence that the employment of the staff of Credit Suisse will be continued.

On Sunday, Credit Suisse has been informed by FINMA that FINMA has determined that Credit Suisse’s Additional Tier 1 Capital (deriving from the issuance of Tier 1 Capital Notes) in the aggregate nominal amount of approximately CHF 16 billion will be written off to zero.

In consideration of the unique circumstances affecting the Swiss economy as a whole, the Swiss Federal Council is issuing an emergency ordinance (Notverordnung) tailored to this particular transaction. Most importantly, the merger will be implemented without the otherwise necessary approval of the shareholders of UBS and Credit Suisse to enhance deal certainty.

Axel P. Lehmann, Chairman of the Board of Directors of Credit Suisse said: “Given recent extraordinary and unprecedented circumstances, the announced merger represents the best available outcome. This has been an extremely challenging time for Credit Suisse and while the team has worked tirelessly to address many significant legacy issues and execute on its new strategy, we are forced to reach a solution today that provides a durable outcome.”